maryland earned income tax credit stimulus

For example if you owe taxes for a prior year but expect a tax refund in the current year the federal government doesnt view this as an. See this page on states and taxes or navigate below for more information.

Earned Income Tax Credit Wikiwand

You must have three or.

. As your income increases past this amount the 29 Medicare tax continues but the. Unlike a tax deduction which reduces your taxable income and therefore your tax payment a tax credit reduces the amount of tax you owe dollar for dollar. The earned income tax credit exists to help middle- to low-income individuals and families reduce the amount of taxes they pay and can.

Additional Child Tax Credit. Your earned income must be more than 2500 for 2019. This form shows the income you earned for the year and the taxes withheld from those earnings.

Income tax on the profits that your business made and any other income. For example in the 2021 tax year. The EITC Assistant is a calculator that will help a taxpayer determine if they are eligible for the state Earned Income Tax Credit.

EIC Expansion and Child Tax Credit. That breaks down to 124 Social Security tax and 29 Medicare tax. To qualify one of these must apply.

112500 or less for heads of household. Individuals who reported adjusted gross income AGI of 75000 or less on their 2019 tax returns will receive the full 600 150000 or less AGI for couples filing jointly. This is because the outstanding taxes you owe to the IRS must always be paid first.

The self-employment tax rate on net income up to 142800 for tax year 2021 is 153. State income tax returns vary from state to state. For example if you owe 700 in federal income taxes for 2020 a 1200.

Before any other federal or state agency can garnish your tax refund you must be current on your federal income tax payments. Tax Alert 03-11-2021 Extension of Time to File and Waiver of Interest and Penalty for Certain Filers. Employers must send you your W-2 by January 31 for the earnings from the previous calendar year of work.

If you filed a 2015 tax return based on the initial Form 1095-A and claimed the premium tax credit using incorrect information from either the federally-facilitated or a state-based Health Insurance Marketplace you should determine the effect the changes to your form might have on your return. For copies of state tax returns contact your states Department of Revenue. Some states do not have income taxes at all while some are more automated than others.

Even better and unlike most credits the Recovery Rebate Credit will give you money back even if its more than the tax you owe or paid. For people who earned more than those amounts the size of the check will gradually decrease by 5 for every 100 earned over that threshold. If your Child Tax Credit is limited because of your tax liability you might be able to claim the additional Child Tax Credit.

If You Dont Receive a W-2. Get Your W-2 Before Tax Time. Prepare your 2021 Federal and.

Comparing the two Forms 1095-A can help you assess whether you. Tax Alert - Maryland RELIEF Act 4202021 - Superseded.

Lying About Your Earned Income Just So You Score An Earned Income Tax Credit May Backfire Badly Like Consulting Business Tax Credits Tax Preparation Services

Irs Child Tax Credit Payments Start July 15

Earned Income Tax Credit Who Qualifies Changes For 2022

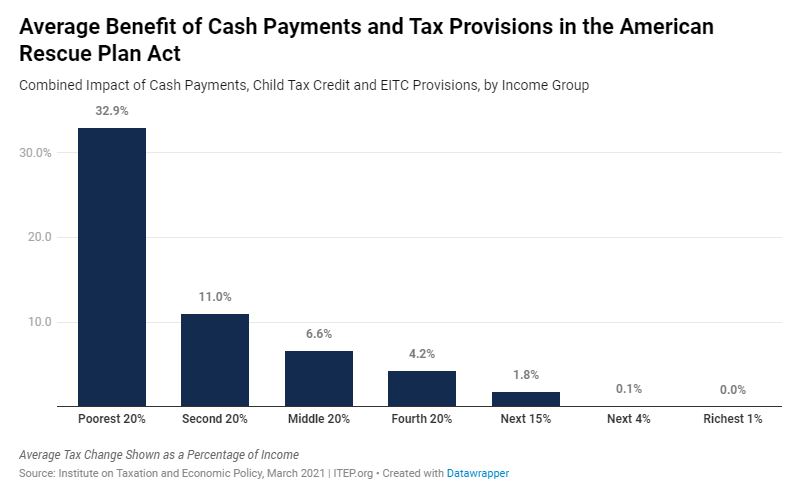

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

Cash Benefits And Tax Credits For Ufcw Members In The American Rescue Plan Ufcw 360

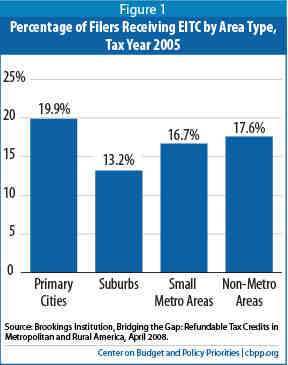

How Do State Earned Income Tax Credits Work Tax Policy Center

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities

What Are Marriage Penalties And Bonuses Tax Policy Center

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZW77UH7G7RG2HMO4GQZJCK2HC4.png)

Changes To Tax Benefits Could Boost Refunds For Many Families

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Earned Income Tax Credit Wikiwand

Covid 19 Tax Policy Resources Itep

Earned Income Tax Credit Eitc Qualification And Income Threshold Limits Income Tax Tax Credits Earnings

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Child Tax Credit What We Do Community Advocates

Earned Income Tax Credits By State Explained Can You Get Up To 6 700 Extra